Show Your Appreciation with a Plan That Protects Her Legacy

Mother’s Day is a time to celebrate the incredible women who raised us, loved us, and taught us life’s most important lessons. While flowers and cards are great ways to say “thank you,” there’s a deeper, more lasting way to show appreciation: helping your mom create (or update) her estate plan.

Estate planning isn’t just for the wealthy, it’s for anyone who wants to make sure their wishes are honored, their loved ones are protected, and their legacy lives on. If your mom doesn’t have a plan in place yet, now is the perfect time to talk about it. And if she already has one, there’s no better way to show you care than by helping her review and update it.

Why Estate Planning Is an Act of Love

Estate planning is one of the most thoughtful and loving gifts someone can give to their family. It brings peace of mind, minimizes confusion and conflict, and ensures that hard-earned assets are passed down with care. For mothers, it’s a way to:

- Protect children and grandchildren

- Make healthcare wishes clear

- Reduce stress for loved ones

- Leave behind more than just money—a legacy of values, stories, and intention

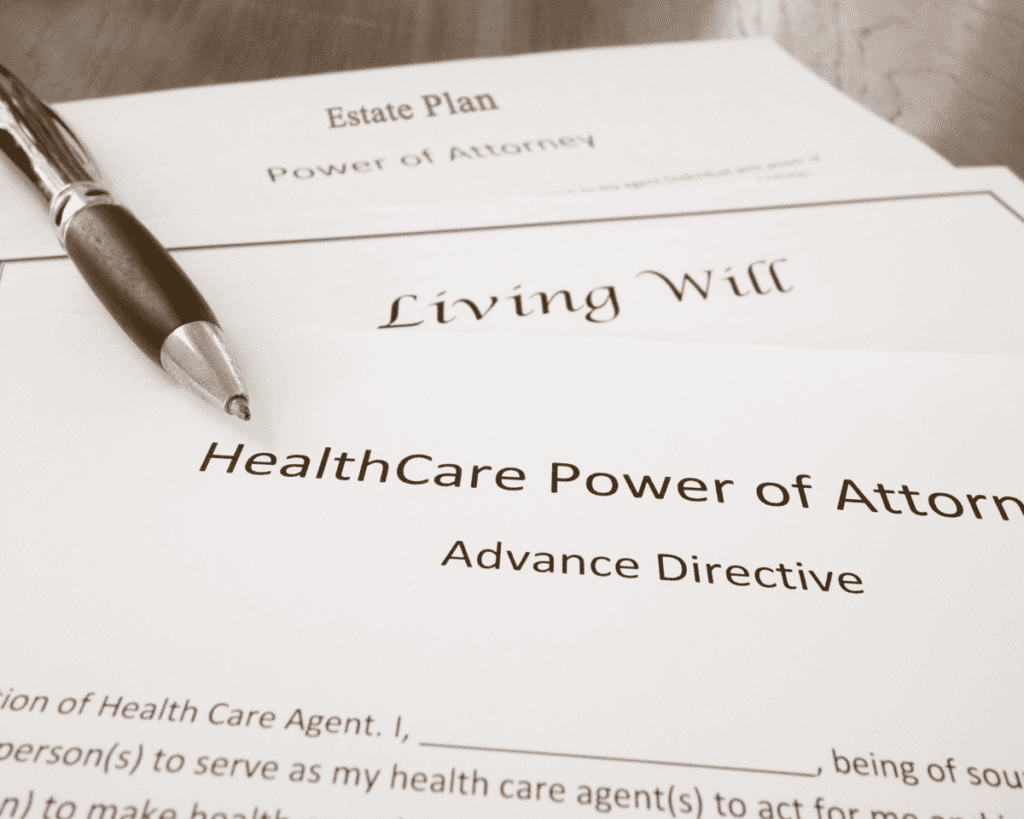

Help Mom Take the First Step: Key Documents She Needs

A complete estate plan isn’t just about a will. It includes several essential documents that work together to provide legal clarity and emotional peace. Here are the basics:

1. A Revocable Living Trust or Will

This document explains how your mom wants her assets distributed and who should be in charge of carrying out her wishes. A trust also allows assets to avoid probate, which can be a lengthy and costly court process. This is particularly helpful for families who want to keep personal matters private and out of court.

2. Durable Power of Attorney

This gives someone the legal authority to handle financial matters if your mom becomes unable to do so. It can help prevent delays or confusion in a crisis, ensuring that bills are paid and important decisions are made without interruption.

3. Advance Healthcare Directive

This outlines medical wishes and names a trusted person to make healthcare decisions if she’s unable to speak for herself. It can cover preferences for life support, resuscitation, and pain management.

4. HIPAA Authorization

This document gives doctors permission to share her medical information with chosen family members. Without it, even close family could be denied access to crucial health updates in an emergency.

For a more detailed breakdown of these documents and when to create them, check out our article on 4 Priority Milestones for Estate Planning.

Don’t Forget Her Digital Life

These days, we live so much of our lives online. From banking apps and social media accounts to photo storage and email, digital assets are easy to overlook—but just as important to include in an estate plan.

Does your mom have passwords saved only in her memory? Are there family photos stored in the cloud? If so, helping her inventory these digital assets and designate who can access them is a vital step.

Your mom can leave a list of accounts, logins, and passwords in a secure place, or use a password manager to keep track. Including instructions in her estate plan about how to access and manage these accounts will help ensure that nothing is lost or forgotten.

Learn more about how to include digital accounts in a plan in our guide: Why You Should Include Digital Assets in Your Estate Plan.

Having “The Talk” with Mom

Bringing up estate planning can feel awkward—but it doesn’t have to be. Mother’s Day can be the perfect time to show your love by asking thoughtful questions:

- “Have you had a chance to look at your will or trust lately?”

- “Is there anything I can do to help you get things organized?”

- “Have you ever thought about what you’d want us to do if something unexpected happened?”

Approach the topic with kindness, respect, and a focus on how you want to honor her wishes—not take control. You might share your own intentions or recent steps you’ve taken and ask for her guidance or input. Framing the conversation as a way to care for the family together makes it feel collaborative, not confrontational.

Update What’s Outdated

If your mom already has an estate plan, it may still need some love. Outdated plans can cause as many problems as no plan at all. Encourage her to check:

- If beneficiaries are still accurate

- If trustees or power of attorney agents are still appropriate

- If her wishes or assets have changed

Has she remarried? Has a family member passed away or moved? Are her children now adults? All of these are signs that her plan may need to be updated.

We often see families face legal hurdles because they assumed their loved one’s estate plan was “done.” The truth is, these documents should be reviewed every 3–5 years, or after a major life change.

Make Estate Planning a Family Affair

One of the best ways to show your mom that her legacy matters? Lead by example. If you haven’t created your own estate plan yet, doing so not only protects your family—it shows your mom that the values she taught you about responsibility and care have stuck with you.

You could even make it a joint goal: “Let’s both get our estate plans done this year!” It’s a powerful bonding experience, and it opens the door for deeper conversations about values, family history, and future wishes.

Estate planning doesn’t just protect money, it protects relationships. When a plan is in place, your family isn’t left to guess or argue. That peace of mind is a priceless gift.

Join Us for an Estate Planning Workshop

Want to learn more in a welcoming, no-pressure environment? We invite you to attend one of our free estate planning workshops, where our attorneys explain the basics and answer your questions. These workshops are designed to help you—and your mom—feel confident and informed.

Our workshops are perfect for families who want to:

- Understand how trusts and wills work

- Learn how to avoid probate

- Get clarity on medical decisions and powers of attorney

- Ask questions in a relaxed setting

A Lasting Gift that Goes Beyond One Day

Mother’s Day comes and goes in the blink of an eye, but an estate plan is a gift that keeps on giving—long after the flowers have wilted and the cards are tucked away. It’s a powerful act of love that ensures your mom’s voice is heard, her wishes are respected, and her family is spared unnecessary stress. In many ways, creating or updating an estate plan is like writing a love letter to future generations. It says, “I cared enough to plan ahead.”

Helping Mom Reflect on What Matters Most

Estate planning isn’t just about documents, it’s about decisions. As you help your mom start or update her plan, you’ll naturally explore questions that reflect what’s most important to her. For example:

- What values does she hope to pass down?

- Are there sentimental items she wants to give to specific people?

- Does she have charitable causes she’d like to support?

- Who does she trust to make financial or medical decisions on her behalf?

These conversations can lead to meaningful stories and even laughter. It’s not uncommon for families to learn something new about each other in the process, like a long-held family tradition or a long-lost photo album with special memories attached. These discoveries can be preserved in her plan—and treasured forever.

The Emotional Benefits of Estate Planning

We often think of estate planning as purely practical, but there are deep emotional rewards too. For many moms, putting a plan in place brings a sense of relief and empowerment. It means they’re not leaving their children with unanswered questions or emotional burdens.

It also provides comfort during uncertain times. If your mom experiences a sudden illness or needs long-term care, knowing her wishes are clearly stated can lift a tremendous weight off the shoulders of her loved ones. Instead of making difficult choices in the dark, your family can follow her guidance with confidence and unity.

Make It Easy for Mom to Say Yes

Even if your mom knows she needs an estate plan, it can feel like a daunting task. That’s where you can help by removing obstacles. Offer to:

- Schedule the initial consultation for her

- Attend the appointment with her as a support person

- Help her gather necessary documents like deeds, financial account statements, or contact lists

- Provide her with printed guides or FAQs so she can read at her own pace

You don’t have to be an expert, just a patient and encouraging presence.

This Mother’s Day, Go Beyond the Bouquet

Yes, flowers are lovely. So are brunches, framed family photos, and heartfelt cards. But if you’re looking for something truly special this Mother’s Day, give your mom the support she needs to protect her legacy.

Helping her create or update her estate plan is more than just paperwork—it’s a gesture that says:

I see how hard you’ve worked for our family. I want to make sure everything you’ve built is protected and honored.

Or Call Us Today

If you’re ready to get started or want help reviewing your mom’s current plan, we’re here for you. Our team is compassionate, experienced, and dedicated to helping families protect what matters most.

📞 Call us today at 951-494-6472 or visit Estate Planning Workshop – Shoup Legal to reserve your spot at an upcoming workshop.